Shannon Grey, CFP®, CRPC®, MPAS®

Managing Director InvestEdge Planning

June Market Commentary

The Limits of Data in an Ever-Changing Environment

May Recap and June Outlook

May was a month of differing perspectives. Markets turned positive on a belief that a solution on tariffs would be eventually forthcoming, and the continued whipsawing headlines began to have a muted impact. The Fed stuck to its position that more data was needed before a further move on rates. Economic data remained positive, painting the picture of an economy that is still healthy and potentially resilient. Economists and other observers, however, began to tilt somewhat towards a scenario in which challenges begin to arise.

Developing a clear picture of what is going on is becoming increasingly difficult. Tariffs are the biggest wildcard, as the effective rate of tariffs moves drastically, seemingly from day-to-day, so calculating the impact becomes challenging. Positive data, such as the May non-farm payrolls beating expectations, brings with it a double-edge sword – good news now, but complicates the decision of the Fed in resuming interest rate cuts.

Let's get into the data:

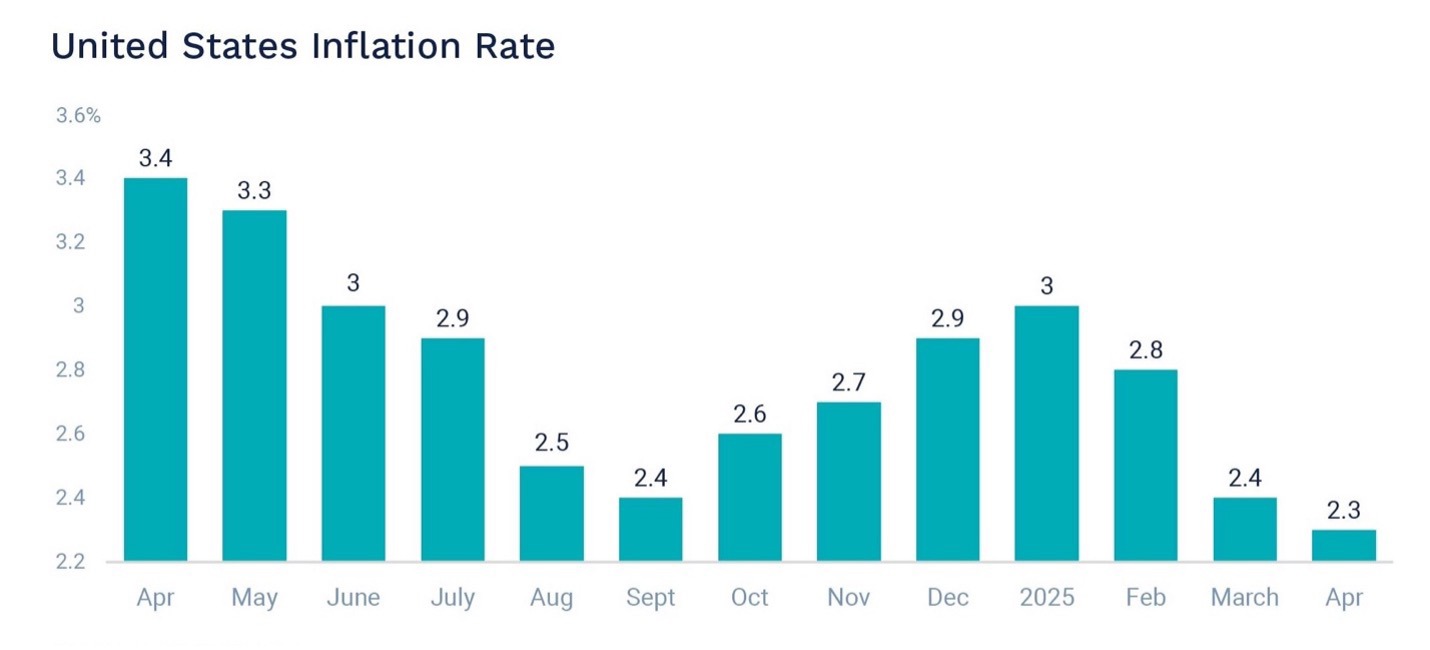

- Inflation, as measured by CPI, hit a significant low. For the 12 months ended in April, CPI was 2.3%, the lowest since February 2021. The monthly number rose 0.2%.

- Non-farm payrolls for May came in at 139,000. The U.S. Bureau of Labor Statistics reported that the labor market added slightly more than the 130,000 jobs that were expected, and the unemployment rate stayed at 4.2%.

- Business Activity has slowed. The Institute for Supply Management’s (ISM) benchmark® fell below the 50-point demarcation line between growth and contraction. New orders also fell, to the lowest point since December 2022, when inflation was raging.

- GDP appears to be rebounding. The Atlanta Fed’s GDP Now estimate for Q2 was at 3.8% in early June.

What Does the Data Add Up To?

Outside of the stock and bond markets, the market everyone is watching is the real estate market. The view here isn’t good. The potentially extended pause in interest rate cuts and the uncertainty brought on by tariffs and gradually rising prices is creating a lose-lose situation for buyers and sellers. The “sellers” market we’ve seen over the last few years has lost steam, and according to RedFin, sellers now outnumber buyers by 34%, the biggest gap in over 12 years. Mortgage rates rose steadily over the last month, breaching 7.0%, before finally dropping in the first week of June. High rates are keeping buyers on the sidelines.

What will the Fed do? Pressure to cut rates is clear, and in recent days the conversation over whether the Fed will be “too late” again, as they were in 2022 when inflation spiked and the Fed didn’t act, under the belief that the increase in prices would be transitory. With inflation finally near 2%, the fear now is that the economy will fall into the only thing possible worse than high inflation.

Stagflation is when prices are rising but the economy is not growing. For the Fed, the risk is that acting too quickly to cut interest rates in an attempt to inoculate the economy against the economic pain caused by tariffs will just increase inflation, which will put pressure on consumers, who will respond by cutting demand. With 70+% of GDP fueled by consumers, that will result in a stagnant or shrinking economy. And around we go. The CME Group’s FedWatch tool is currently projecting the first rate won’t be likely until September.

Even if the economy does fall into stagflation, there is some hope that it will be short-lived. The decrease in consumer demand coupled with a slowdown in business investment related to the initial impact of tariffs could create a slump that will ultimately put pressure on wages and prices.

Chart of the Month: Inflation Is Trending Down for Now

Source: Bureau of Economic Analysis

Equity Markets in May

- The S&P 500 was up 6.15% for the month

- The Dow Jones Industrial Average gained 3.94% for the month

- The S&P MidCap 400 rose 5.25% for the month

- The S&P SmallCap 600 increased 5.07% for the month

Source: S&P Global. All performance as of May 30, 2025.

Ten of the eleven S&P 500 sectors had positive returns, with Information Technology out front for the second month in row, up 10.79% and Health Care in last place, down 5.72%. The Magnificent added significantly to May’s returns, after struggling earlier in the year. Monthly intraday volatility, measured as the daily high/low, decreased to 1.09% in May from April’s 3.21%. Earnings season is nearly complete, with 488 issues having reported, and 377 of those (77.3%) beating estimates on earnings.

Bond Markets in May

The 10-year U.S. Treasury ended the month at a yield of 4.40%, up from 4.18% the prior month. The 30-year U.S. Treasury ended May at 4.92%, up from 4.69%. The Bloomberg U.S. Aggregate Bond Index returned -0.39%. The Bloomberg Municipal Bond Index returned -0.13%.

The Smart Investor

We are at the mid-point of the year, so it’s time to get back to basics and take stock of where you are compared to what you wanted to accomplish this year. Before summer gets into full swing, it’s a good idea to take time to review the core components of your plan: spending, saving, and investing.

- Are your budgets in line with expectations? Do you have any big expenditures coming up? Is your emergency fund topped up? A reality check of where you are can help you keep spending under control as the lazy days of summer get underway. Vacation spending has a tendency to be difficult to keep in budget, so having a realistic picture of your spending so far can help you set good limits.

- Rates are still high, so locking in a CD or even moving money into a higher yielding saving account can add to your significantly to your compound savings rate.

- A difficult first quarter has turned around for now, but the losses may present opportunity. If you usually wait until year end for tax-loss harvesting, you may want to think about doing it now to capture some benefit from the downturn.

This work is powered by Advisor I/O under the Terms of Service and may be a derivative of the original.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

Disclosure information

InvestEdge Planning LLC is a registered investment advisor offering advisory services in the State of California and Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The information on this site is not intended as tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This information should not be relied upon as the sole factor in an investment-making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal any performance noted on this site. The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, InvestEdge Planning LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose. InvestEdge Planning LLC does not warrant that the information on this site will be free from error. Your use of the information is at your sole risk. Under no circumstances shall InvestEdge Planning LLC be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if InvestEdge Planning LLC or InvestEdge Planning LLC's authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized. Opt-out of future communications by emailing shannongrey@investedgeplanning.com.