Shannon Grey, CFP®, CRPC®, MPAS®

Managing Director InvestEdge Planning

January Market Commentary

Seems Like Old Times?

December Recap and January Outlook

The inauguration of only the second U.S. president to win two non-consecutive terms (Grover Cleveland was the first) is historic by a host of measures. Starting a second term of office with the president’s party controlling both houses of Congress gives rise to expectations of an opportunity to move the goalposts on what worked well, and succeed on aims that fell short the first time around.

However, the economy is in a very different place than it was eight or even four years ago. Will a new economic cycle and a vastly different interest rate environment change plans and outcomes?

Let's get into the data:

Inflation, as measured by CPI, bumped up slightly. CPI rose 2.7% for the 12 months ended in November. While not a huge increase, it’s not the downward trend the Fed wants.

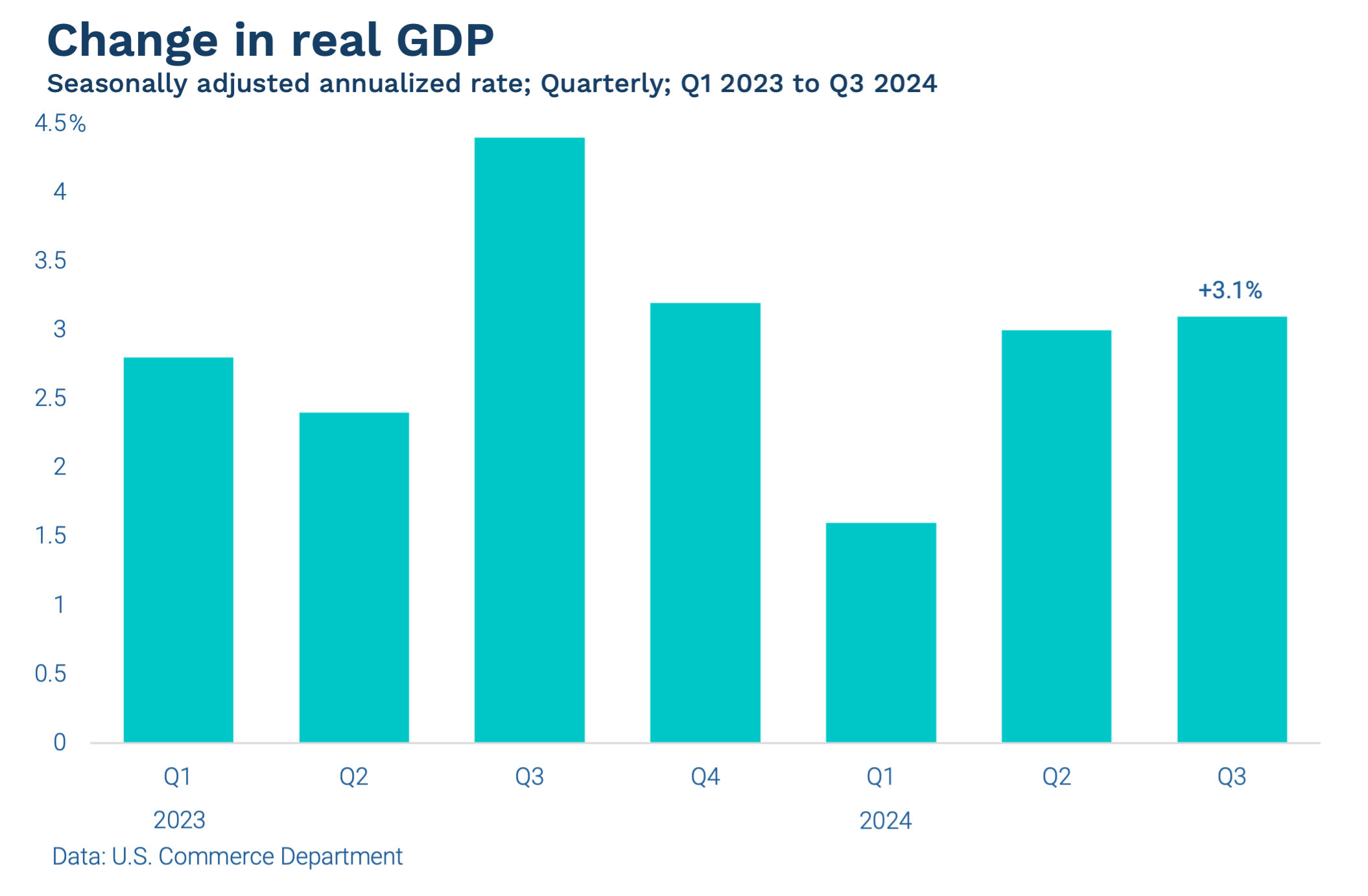

GDP rose at a 3.1% annualized rate in the 3rd quarter. This marked the strongest rate of quarterly expansion of the year, driven by consumer spending and government outlays.

Businesses are very optimistic. The Business Roundtable’s economic outlook index climbed to 91 from 79 in the third quarter, hitting the highest level in two years.

Mortgage rates reversed course. As of the end of the first week of the month, mortgage rates hit 6.9%, the highest level in six months, according to Freddie Mac.

What Does the Data Add Up To?

GDP is up, inflation is holding steady, and the labor market remains solid. The Federal Reserve cut rates three times in 2024, for a total 100 basis point decrease in the key short-term rate, to a target range of 4.25%-4.5%. Two more rate cuts are expected in 2025, based on the predictions of the Fed’s dot plot. The Fed has for now delivered a soft landing, and is in a position to adeptly navigate further rate cuts while keeping the economy blooming.

So with a strong economy, the uncertainty of the election removed, and a pro-business regime about to take power, why is the bond market looking so spooked? The yield on the 10-year U.S. Treasury notes climbed to 4.71% as of January 8th, up over 100 basis points from its level in mid-September.

Longer-term rates in the bond market correspond to views on inflation, the strength of the economy, and other factors. Rates going up signals that investors are demanding to be compensated for additional risk.

While the potential for a radical expansion of the United States’ footprint from Greenland to Panama is great copy, it’s probably not the reason for bond market jitters. Closer to home, the impact of bigger deficits resulting from tax cuts may be the culprit. While increased tariff revenue could shrink the deficit, it would likely also bring inflation back to life, which could result in the Fed raising rates and tamping down the economy.

For now, all the pieces of the new agenda are still being determined. There will be trade-offs, and likely some traditional horse trading between and amongst the parties.

Chart of the Month: GDP ends the year on a high note

Equity Markets in December

The S&P 500 was down 2.50% for the month

The Dow Jones Industrial Average fell 5.27%

The S&P MidCap 400 decreased 7.29% for the month

The S&P SmallCap 600 was down 8.12%

Source: S&P Global. All performance as of December 31, 2024

The Magnificent 7 group was 53.1% of the S&P 500’s total return for 2024. For the year, Communication Services was the winner, up 38.89%. Materials was the only negative sector for 2024, down 1.83%. In December, only three of the 11 GICS sectors increased. The index saw breadth decline dramatically, with only 54 issues up for the month.

Bond Markets in October

The 10-year U.S. Treasury ended the month at a yield of 4.58%, up from 4.18% the prior month. The 30-year U.S. Treasury ended December at 4.78%, up from 4.48%. The Bloomberg U.S. Aggregate Bond Index returned -1.51%. The Bloomberg Municipal Bond Index returned -1.46%.

The Smart Investor

A new year gives you a new chance to review your goals. While New Year’s resolutions have something like a 90% failure rate, the changes you make to your investment plan may be more successful and lasting. The key? Don’t do it all at once.

Taking the time to review your situation, your budget, your income, your debt and most importantly—your goals— can help you make incremental changes that will work together to keep you on track.

Tying your goals to your finances can keep you focused, create motivation and momentum, and also impose discipline.

Laying out a roadmap of changes you need to make, and planning the optimum time for them is key. For example:

Is your portfolio in line with your risk tolerance? With volatility likely on the horizon, be sure to understand what you are comfortable with, so you can sleep at night.

Do you want to increase retirement savings? Contributing more to tax-advantaged vehicles is a great starting point. But looking at your investments can also help ensure you are making the most of what you have saved.

If you need to realign your portfolio, think about how you decrease or increase positions. Keeping your risk tolerance and your asset allocation intact can be a balancing act.

Combining personal goals, investments, and a view on the economy is at the core of what a financial advisor can bring to the table. We’re always here to help.

This work is powered by Advisor I/O under the Terms of Service and may be a derivative of the original.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

This content not reviewed by FINRA

Disclosure information

InvestEdge Planning LLC is a registered investment advisor offering advisory services in the State of California and Arizona and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The information on this site is not intended as tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This information should not be relied upon as the sole factor in an investment-making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal any performance noted on this site. The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, InvestEdge Planning LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose. InvestEdge Planning LLC does not warrant that the information on this site will be free from error. Your use of the information is at your sole risk. Under no circumstances shall InvestEdge Planning LLC be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if InvestEdge Planning LLC or InvestEdge Planning LLC's authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized. Opt-out of future communications by emailing shannongrey@investedgeplanning.com.